As October comes to an end, both the people of Moldova and Georgia are facing up to their choice for a pro-European future.

Both countries face critical elections that will be decided upon the fundamental cleavage line of pro-Western sentiment. Moldova held the first round of presidential elections on October 20, alongside an EU Referendum that barely passed, while Georgia will hold parliamentary elections on October 26.

It is a very high stakes gamble that pro-Western political elites are making in support of European accession, as Russian interference ironically amplify fears of Russian aggression and economic precarity.

What many still ignore is the single, interconnected front between the war in Ukraine and the malign threats that Moldova and Georgia are facing. In contrast to the physical and human destruction of Ukraine, Russia managed to achieve a lower investment agression in Moldova and Georgia: playing up political and social cleavages to stall the European integration process for these two countries.

Moldova’s lack of conviction

Moldova is currently facing an unprecedented scale of malign interference from Russia directed at distorting the electoral process.

Major threats to the integrity of the electoral process have and will continue to include clientelism or voter coercion, deep fakes and propaganda. Moldovan security experts point to an overall Russian investment of around 100 million euros on interference into Moldovan democratic processes this year.

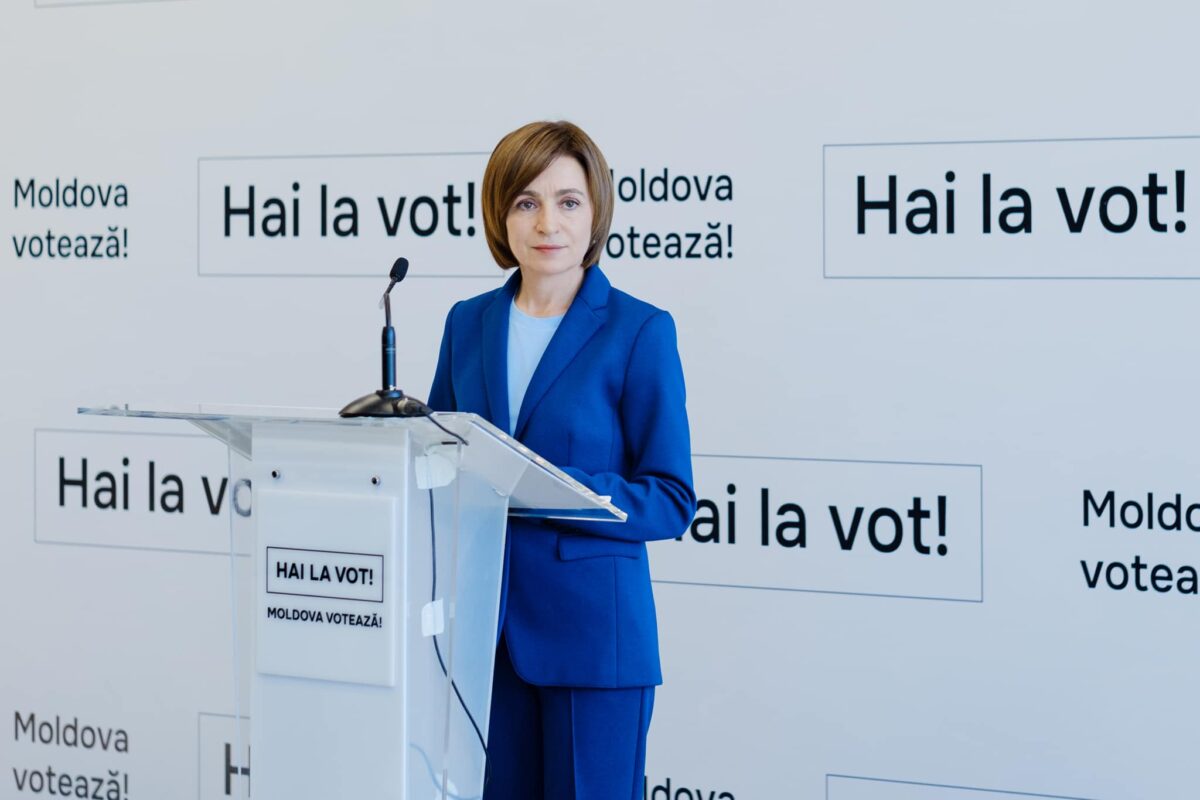

The EU referendum passed by a knife-edge in favour of EU integration, and incumbent Maia Sandu (pictured above) placed first in the presidential election. Sandu now goes into a run-off with Aleksandr Stoianoglo, an independent former prosecutor general who is supported by the pro-Russian Party of Socialists.

Three categories of public opinion preferences shape the Moldovan electorate on the foreign policy agenda. One third are pro-Western supporters of Maia Sandu and her ruling party PAS.

They reside in Chișinău or the diaspora, are relatively affluent, work in the government or the private sector and have a very sophisticated engagement with the EU already. One third are pro-Russian supporters of any of the wide variety of political candidates on display backed by money from Ilan Shor. The poor, rural, pro-Russian voters were mobilised through the Shor clientelistic pyramid, while most of the undecided were mobilised through online channels and propaganda messages.

Finally, 42 per cent of the population are still hoping for normal relations with both the European Union and Russia and have been responding to the foreign policy balancing act proposal of Maia Sandu’s contesters.

Notably, the Moldovan government claimed 300,000 votes were mobilised through vote-buying techniques, which is a rough mirror of the 240,000 votes mobilised in the diaspora. This means that the clientelistic networks did not bring this election to such a close finish, but rather the overlap of multiple methods of electoral mobilisation and propaganda dissemination—from word-of-mouth to digital, from monetary incentives to cultural appeal.

The Kremlin is now employing in Moldova both direct and indirect tactics, ranging from overt support and endorsement for pro-Russian political actors that undermine the incumbent government and the pro-European agenda (such as US sanctioned Evghenia Gutul, Gagauzia Governor) to subversive clientelist operations coordinated by Ilan Shor from within Russia, or disinformation propaganda on social media channels (prominently Tik Tok and Telegram).

There is a very strong coordination between online and offline engagement of pro-Russian actors, targeting the majority of the population who feel still undecided.

The strength of the Russian interference was larger inside Moldova than outside. Its strength lies in its diversity, targeting different segments of the electorate by different means.

The diaspora being more widely spread, more culturally diverse, and more socialised inside the European Union, was much harder to target effectively through these overlapping tools. The most Russia could do in the Moldovan diaspora was to disseminate social media conspiracy messages that have a limited mobilisation capacity in the given context. But, the Moldovan diaspora is still more susceptible to Russian propaganda than before (such as the last elections) due to social media propagation and penetration of disinformation in Western European societies.

Russian propaganda is not delivered only through Russian language, but increasingly more so from Romanian language sources too, which requires a better coordinated countermeasures between Romania and Moldova.

While the EU Referendum has passed and Maia Sandu has a strong chance to win a second term as president in the second round, PAS is unlikely to hold on to its majority in the parliamentary elections next year.

Therefore, there is a critical need for a pro-Western coalition party, but none of the current parliamentary parties offer that perspective in a convincing manner. Most likely, one or several new parties will emerge before the parliamentary elections, and, depending on their results, have the potential to serve as a ‘kingmaker’.

Georgia’s fight on the streets

Civil society actors in Georgia are very strong, well-coordinated and have the capacity to deploy large scale citizen electoral observation and citizen participation activities.

In contrast, political parties continue to develop a weak opposition to the incumbent Georgian Dream, by being highly fragmented still, not having a clear opposition leader, not having a clear message for the electorate apart from their pro-European stance and not engaging well enough with the regions.

The incumbent Georgian Dream government is leading its campaign on themes that resonate well with the Georgian public without an actionable agenda or true commitment to pursue (such as territorial integrity, Christian values, European integration with dignity).

Through the Foreign Agents Law, which civic activists and opposition parties call the ‘Russian Law’, Georgian Dream is clearly scaling up on repression against any civic or political opposition. It seems to consider, however, civil society a much more reputable adversary than the fragmented opposition parties.

Public officials remain hypocritical with regards to international assistance, as public institutions such as the Central Electoral Commission or local governments are happy to receive USAID or EU assistance, while publicly condemning—through the Foreign Agents Law—the civil society organisations that benefited from such funding in the past.

President Salome Zourabichvili could be the most prominent leader of the opposition, should opposition parties choose to support her.

She sees herself as the opposition leader and proposes a counter platform to Georgian Dream and its founder Bidzina Ivanishvili, based on a Presidential Charter.

All major opposition parties have signed it, but remain reluctant to name Zourabichvili as their leader or to accept her terms regarding a technocrat prime minister and snap elections next next year after judicial and internal affairs reforms are put in place.

Survey polls ahead of Saturday’s parliamentary elections present very large variation between the relative level of support for both Georgian Dream and opposition parties.

Georgian Dream polls anywhere between 30 and 40+ per cent. Should the party get close to the 50 per cent threshold it needs for a new majority, electoral fraud on election day is likely to have much larger stakes and the potential to fundamentally alter the integrity of the election by distorting the final results.

Also, a low margin of difference between the different blocs of the opposition and Georgian Dream is likely to lead to violent protests.

Apart from the civic groups and opposition parties active in Tbilisi, other stakeholders remain on the fence ahead of the upcoming elections.

Economic actors are weak, and the majority do not have an interest in EU integration, as they are often linked to Georgian Dream or pro-Russian networks.

The largest employer is most of the regions is the public sector and there is a very strong negative clientelism (governmental repression against non-supporters). In contrast to Moldova, the Georgian diaspora that is not well engaged or very political with regard to the national elections.

Georgian Dream is also increasingly better coordinated with Hungary in terms of domestic repression tactics and narratives on positioning itself vis-a-vis the EU, as Georgian Dream leaders are engaged in official exchanges with peers from Hungary and publicly point to it as an example of how a country should deal with the EU.

The government strives to hold on to the veneer of seeming having good relations with the West, while developing full, authoritarian control over domestic policies.

Zourabichvili looks to Poland as a key European partner. The current president wants to rally support from various EU member states in order to fund the massive reform programme she envisages for Georgia after the elections, on the assumption that opposition parties manage to gather a majority in parliament.

Supporting pro-Western trajectories in Moldova and Georgia

As domestic stakeholders showcase their preferences in pivotal elections this month for the Eastern periphery of the European Union, it is a good time for international partners to reassess their support for the Euro-Atlantic integration of Moldova and Georgia.

Firstly, international donors should increase not retreat from supporting civil society actors. The Foerign Agents Law is a testimony of how important civic actors are in providing checks and balances in their country. But, domestic actors need broader support, not just funding, and that is why initiatives of peer-to-peer exchanges and outreach, allowing for capacity and network building, are important in developing a coordinated approach and a larger impact in society.

Civic and pro-Western political actors need to reach outside the already pro-Western bubbles of the electorate.

International donors should also increase support for media content production—from investigative journalism to raising public awareness on electoral malpractices.

New, innovative tactics of engagement with younger audiences online (such as original social media content), and rural audiences in person (for example, town hall meetings).

A large share of the population in both Moldova and Georgia remain poorly informed, disconnected from the urban pro-Western elite. Civil society and independent media should be able to work towards linking the EU-integration process to the main fears of the population: Russian aggression, rising prices and inflation, lack of economic opportunities for finding a job or growing a business.

Non-governmental international organisations and think tanks should develop political dialogue platforms, to create a common pro-European integration agenda for as many political parties as possible.

The isolationism of many of the political parties—in power in Moldova, or in opposition in Georgia, is a larger vulnerability than the malign interference of Russia.