Most companies still worship at the altar of endurance. Boardrooms throw parties for centenary milestones. ‘Built to last’ gets bandied about like a virtue. Investors want balance sheets that smell of permanence.

Technology, however, has begun to evolve faster than ever before. Then there are consumer expectations, especially amongst younger generations, which change monthly. Regulations meanwhile take unpredictable turns. If there’s a pattern, it’s this: the most dangerous thing a firm can do is stay the same shape for too long. The corporate graveyard isn’t filled with companies that moved too fast. It’s packed with those that confused longevity with competence.

Companies that managed to camp out on the S&P 500 for three decades in the 1960s now struggle to last 15 years. Average tenure keeps dropping. Of the original Fortune 500 firms from 1955, precisely 52 are still there. The rest are gone.

This isn’t Schumpeterian creative destruction—that romantic notion of better firms displacing worse ones. This is organisational obsolescence happening at speed. Every firm now has a half-life, though few leaders dare acknowledge it. Some capabilities decay gracefully. Others rot from the core whilst everyone pretends not to notice the smell.

Dead weight

Received wisdom says stability equals strength. Nonsense. In a world trending toward chaos, stability signals something else entirely: a slow metabolism. An organisation that can’t shed dead weight when needed.

Watch how executives behave. They rarely kill their own creations. Instead they pump resources into initiatives everyone knows are doomed, because admitting failure feels worse than slow-motion disaster. Call it what you like—executive necromancy, zombie projects, whatever. The pattern holds.

Durability, it appears, isn’t the strategic ideal at all. Some firms already treat whole business units like software features—deploy them, extract value, deprecate them when they stop pulling weight. Not chaos. Not Silicon Valley nihilism either. Just recognition that when volatility becomes normal, staying static costs more than moving.

This is the biodegradable business model, though nobody calls it that at investor roadshows. Product lines launched with explicit kill dates. Capabilities assembled for six-month windows then disbanded.

Building a disposable capability is cheap. Replacing it when needed is even cheaper. Defending a legacy system five years past its sell-by date is, by contrast, eye-wateringly expensive. Disposability cuts complexity, creates options, speeds up learning. Each experiment costs less to abandon than to prop up. This is metabolism. Continuous, unglamorous, necessary.

Fast, healthy decay

Not that everything should rot at the same rate. That’s where most firms get it wrong—they try to preserve what should die and redesign what ought to stay put.

Think of it in layers. Some things (certain product lines, pet projects, yesterday’s bright ideas) should decay fast. Others need to keep mutating to stay relevant—customer-facing capabilities, market-sensing functions, anything that touches changing behaviour.

Then there’s the small stuff worth protecting long-term: trust, governance mechanisms, deep customer insight, network effects that actually compound. Get the classification wrong and you’re dragging strategic dead weight whilst scrapping the things that matter.

Leaders equate longevity with legitimacy. There’s ego involved, obviously—nobody wants to admit their initiative was rubbish. But there’s something else: fear that killing things signals weakness rather than discipline. So in quarterly calls, CEOs bang on about ‘transformation’ whilst guarding the exact structures preventing it. The result is organisations bloated with projects nobody believes in but everyone’s too nervous to terminate.

Designing for decay

The economics point elsewhere. Churn rates keep climbing. Billion-dollar start-ups queue for IPOs like punters at a nightclub. Half of the current S&P 500 will probably be replaced this decade. The survivors won’t be those that lasted longest—they’ll be the ones running enough experiments, fast enough, with low enough attachment to any single bet. Portfolio theory, meet organisational design.

Look at the patterns emerging globally. East Asian manufacturers quietly build teams around production runs, then dissolve them. European scale-ups launch business units with built-in sunset clauses. African fintechs treat products like maize crops—plant when conditions suit, harvest what works, abandon what doesn’t, zero sentiment. This doesn’t make TechCrunch headlines. But the message lands: smart companies assume half their structure won’t survive the next pivot.

So what does designing for decay actually mean? Start with temporary as default. Only invest in things that compound—network effects, customer trust, genuine competitive moats. Give every initiative a sunset date from day one. Kill the invisible rules that make everything immortal by default.

The goal isn’t anarchy. It’s knowing what needs to fall away so reinvention becomes possible rather than theoretical.

Adaptation to reality

Of course, there are risks. Lean too hard into disposability and you get fragmentation, exhausted staff, lost craftsmanship. Make everything temporary and nothing means anything. The trick lies in spotting what deserves permanence—the minimum viable core needed for trust and coherence. Below that threshold, you’re not an organisation anymore. You’re just a series of transactions pretending to be a company.

None of this is a management fad. It’s adaptation to reality. The same forces that gave us planned obsolescence in consumer goods—shorter product cycles, faster replacement rates—now apply to organisational structure itself. Except the goal isn’t extracting value from customers. It’s preventing the firm from becoming its own worst enemy.

The companies that thrive in the next decade won’t be built to last. They’ll be built to learn, adapt, and—when the moment demands it—let things die. The real competitive advantage is knowing what should fade. In other words, having the nerve to let go.

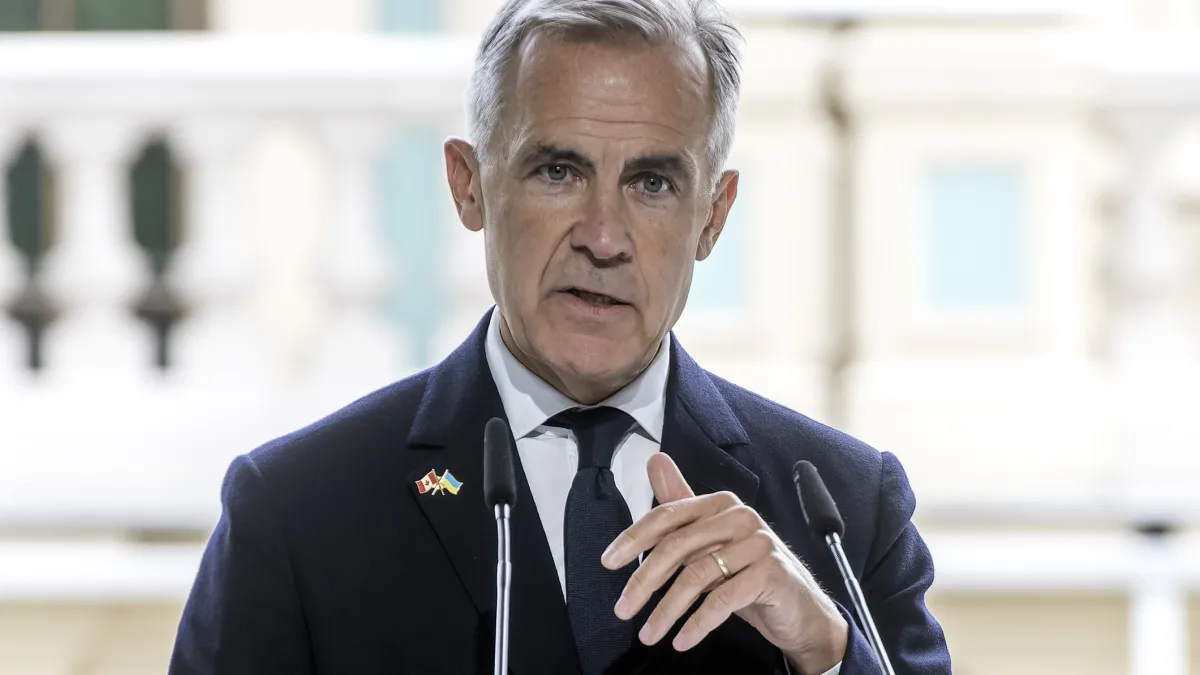

Photo: Dreamstime.